Embarking on Nautical Interior Design

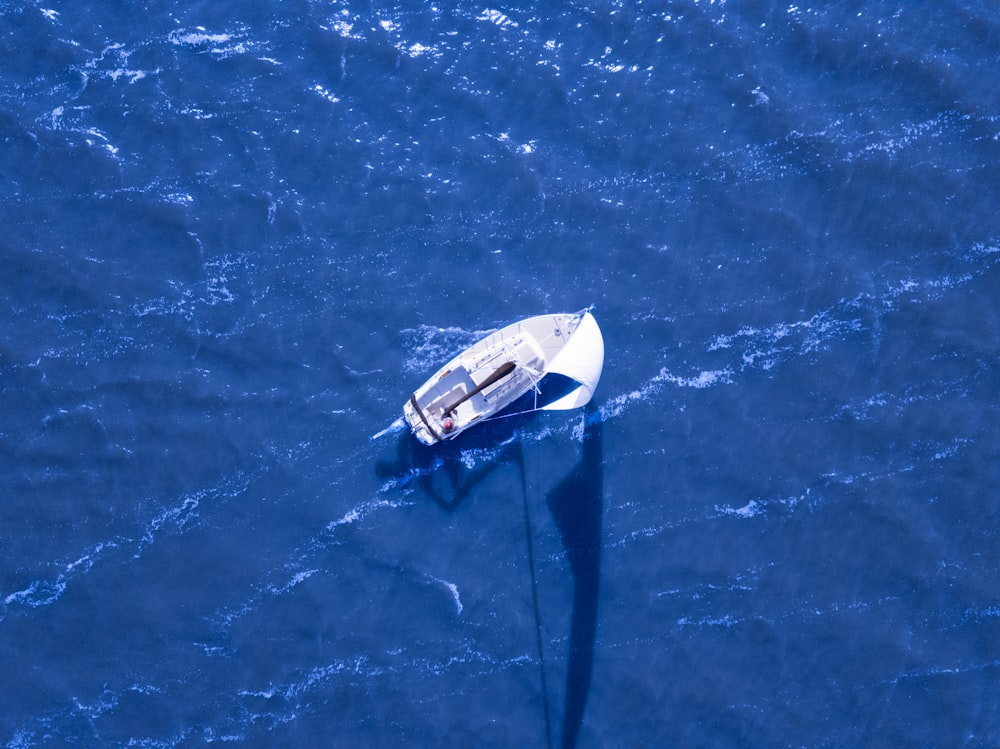

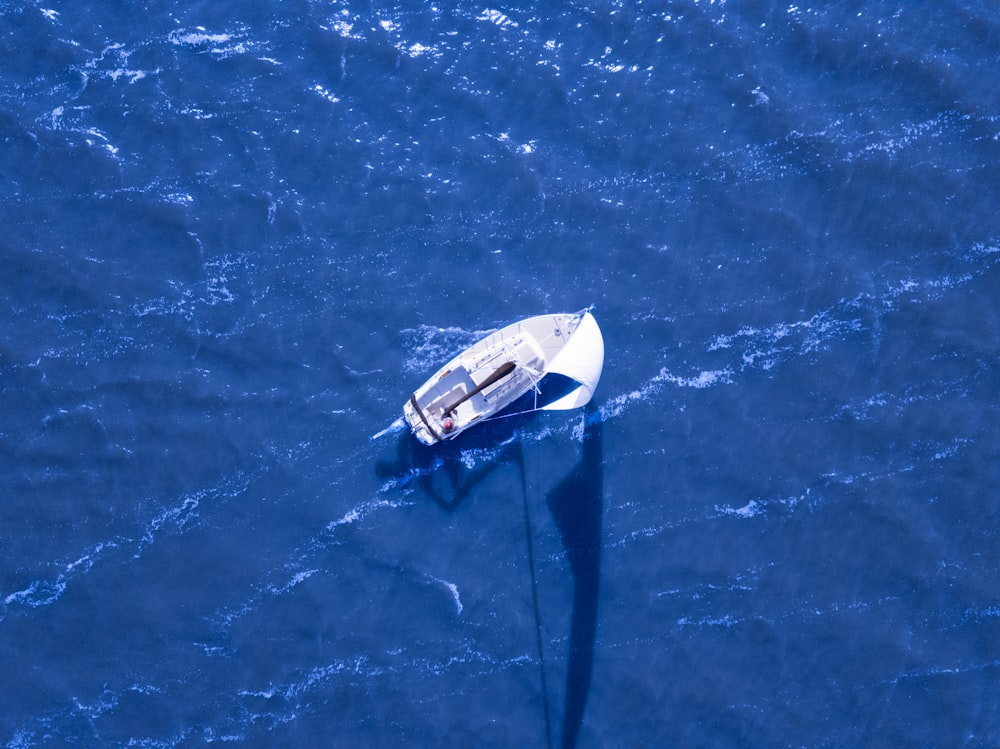

Nautical Inspiration

Imagine bringing the serene beauty of the ocean into your living space. Nautical interior design concepts draw inspiration from the sea, incorporating elements

Introduction

In the dynamic realm of interior design, modern apartment trends continue to evolve, offering exciting opportunities for homeowners to elevate their living spaces. From sleek minimalist aesthetics to innovative

An Urban Escape

Elevated Ambiance

Nestled amidst the vibrant cityscape, the Williamsburg Hotel Rooftop Bar beckons with an atmosphere of refined elegance and urban charm. Perched high above the bustling

Breaking Ground: Exploring Boundaries Towards a New Architecture Vision

Embracing Innovation

In the realm of architecture, pushing boundaries and embracing innovation are essential for progress. Today, architects are exploring new

Introduction

Embarking on a journey to transform your living space into a haven of elegance and sophistication? Look no further than Ravi Interior Design. With their unique approach to design,

Introduction

In the world of interior design, celebrity designers stand out not only for their talent but also for their ability to create spaces that exude luxury and sophistication. Behind

Exploring Elegant Living Room Wall Design Ideas

Embracing Sophisticated Elegance

In the realm of interior design, the walls of a living room serve as the canvas upon which the ambiance

Exploring Chic and Affordable Fashion at Garage Brand

Discovering Affordable Style

In the world of fashion, finding stylish clothing that doesn’t break the bank can often feel like an impossible

Pioneering a Sustainable Future with Eco-Friendly Architecture

Embracing Environmental Responsibility

In an era marked by environmental challenges, eco-friendly architecture emerges as a beacon of hope for a sustainable future. This

Introduction

Step into the world of cozy interior design and discover how to create inviting spaces that embrace comfort and warmth. In this article, we’ll explore inspirations and ideas for